Classroom

LESSONS & MISTAKES; CLASSROOM

Compression no.1

Compression no.2

Compression no.3

ENGULF no.1

ENGULF no.2

ENGULF no.2a

ENGULF no.3

Reason why failed

ENGULF no.4

reason why failed

ENGULF no.5

ENTRY no.1

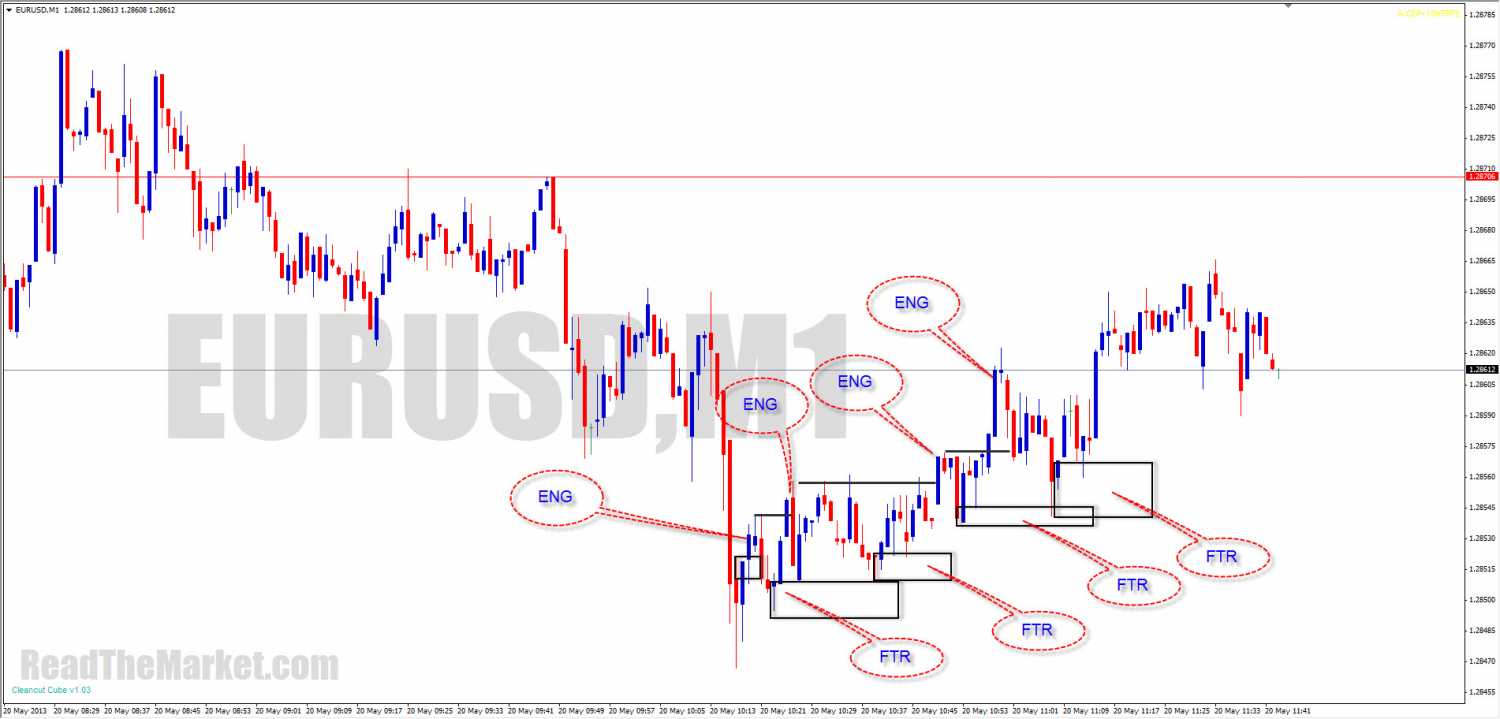

FB FTR

FL no.1

dissected

FL no.2

FL no.3

FL no.4

FL no.5

FL no.6

FL no.7

FL no.8

FL no.9

FL no.10

FL no.11

FL no.12

FL no.13

dissected in Daily

FL no.14

FL no.15

FL no.16

FL no.17

Follow the Decisions

Entry

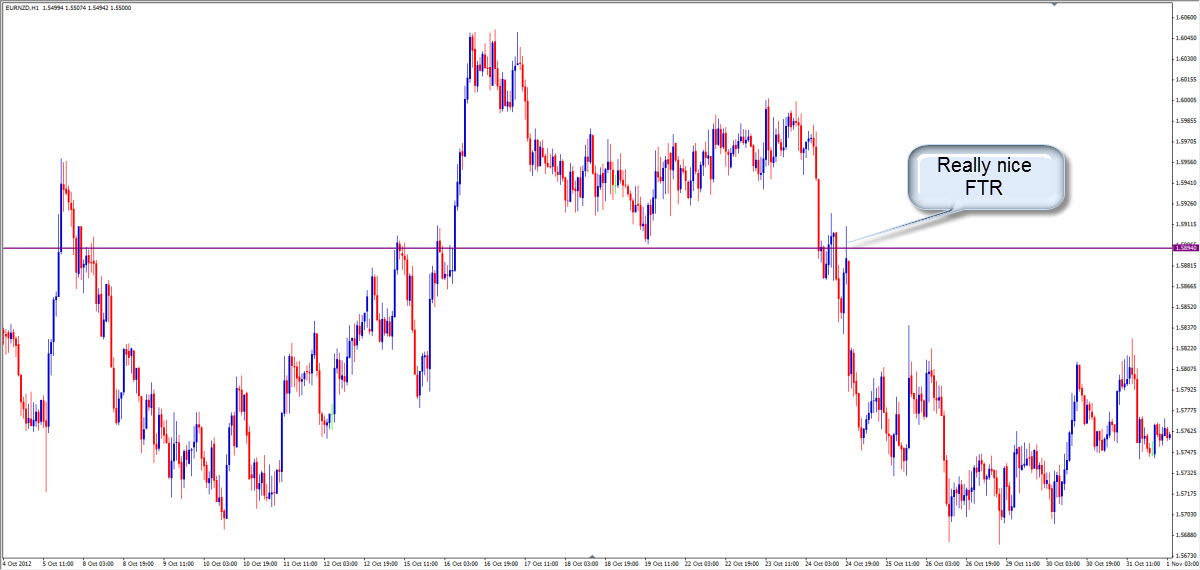

FTR no.1

FTR no.2

FTR no.3

FTR no.4, by Mertsch

PAZ no.1

PAZ no.2

PAZ no.3

PAZ no.4

PAZ no.5

PAZ no.6

PAZ no.7

PAZ no.8

PAZ no.9

FLAG and POLE

Market = Flag vs Flag

BREAK INTO FLAG

If there is a break into Flag (engulf of RS-FL of the FLAG), and price

breaks OUT of the RS-FL again, then intention is clear: pick orders from

FLAG deepest level (MPL), to target the to a flag that was created

after the current Broken-into FLAG.

FLAG BREAKS MEANING

When a Flag breaks into the polebase, it just means that now the FLAG is now extended to the Pole. In otherwords, Pole broken = the whole pole is now a PART (not a separate part) of the FLAG, i.e. Pole base needs to be consumed for the whole FLAG to COMPLETE.Entry: it's always safer to wait for a confirmed FTR built.

MISTAKES

CLASSROOM

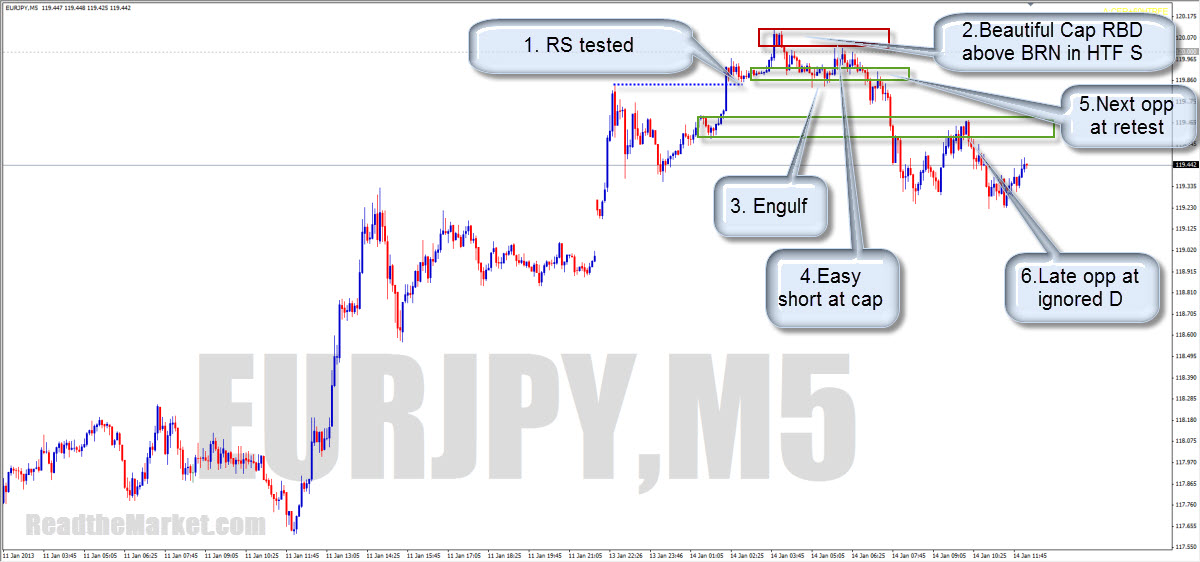

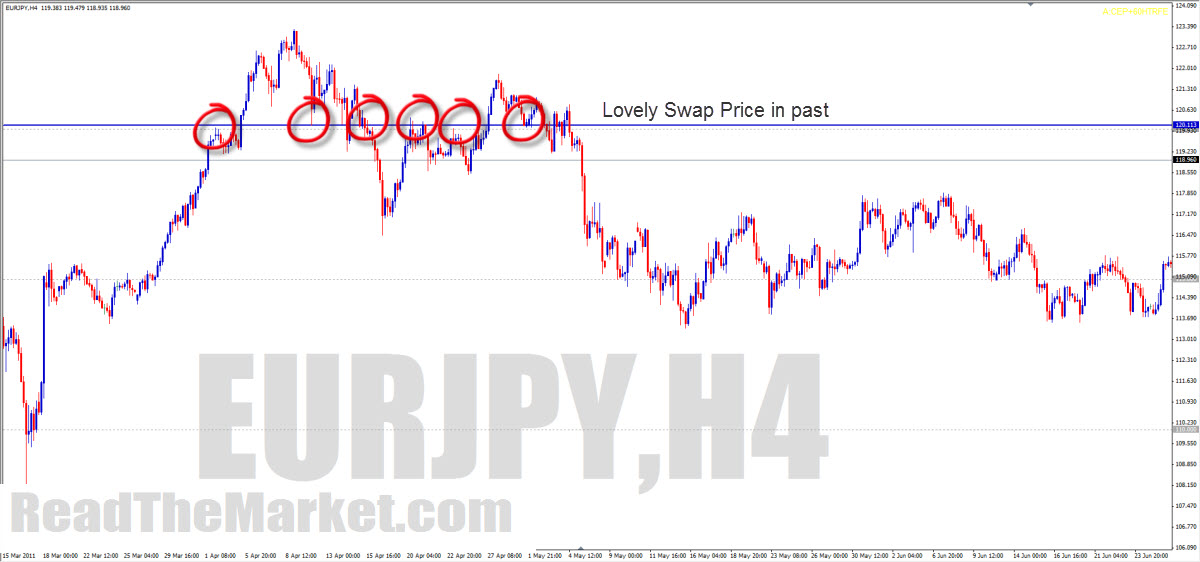

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=25#11084Here was some very simple PA on EJ which was sure to give some green pips

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=25#11085

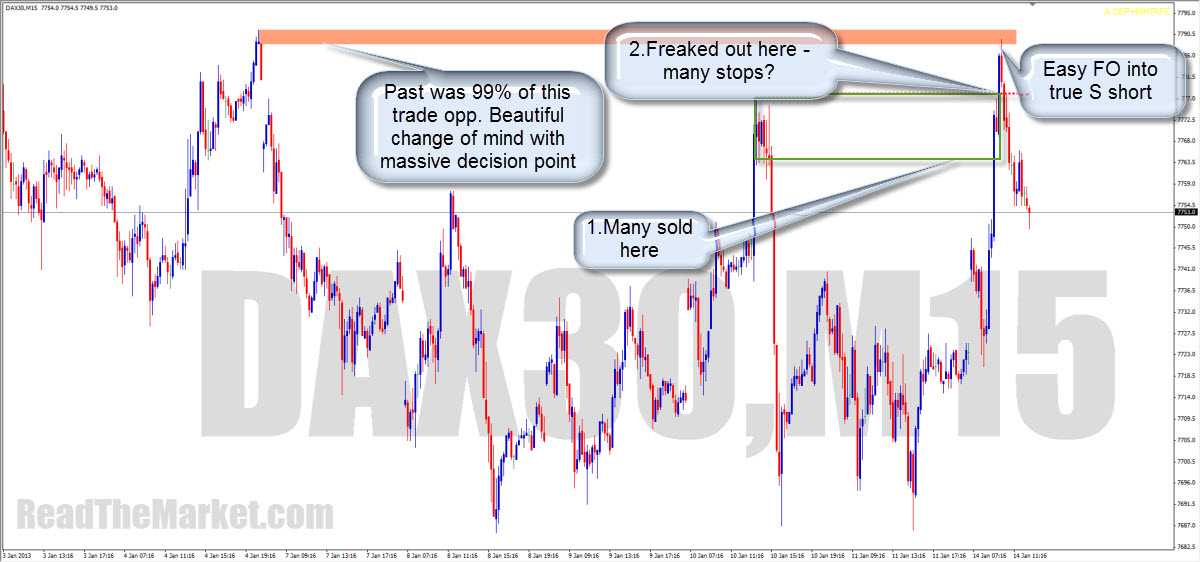

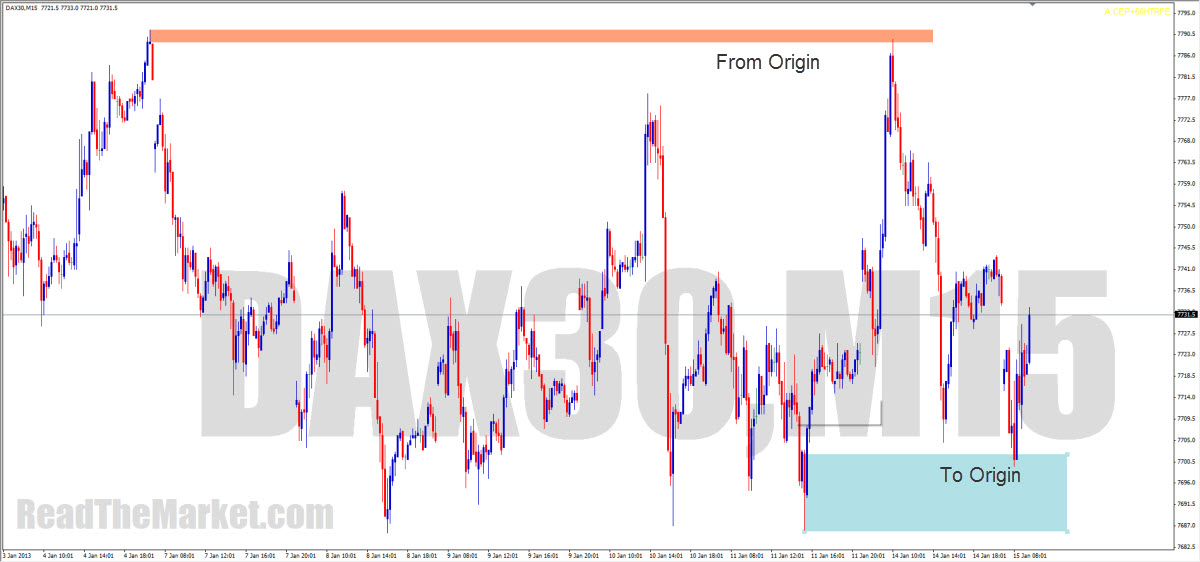

And Dax

How very simple!

Shake out the early sellers, take their stops at true supply - Beautiful

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=25#11093

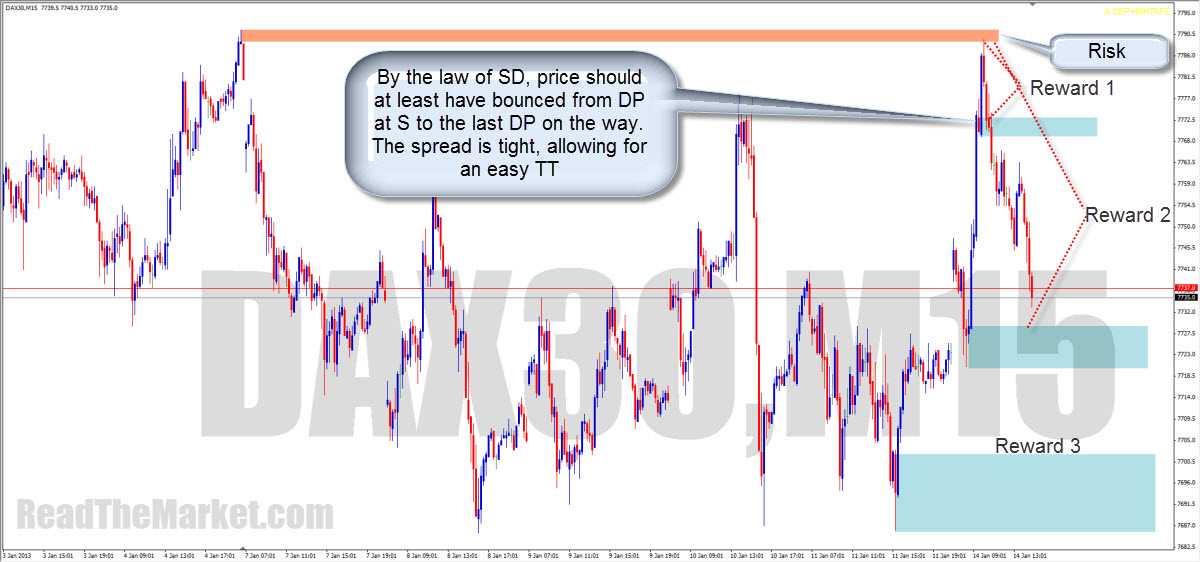

Here's the Dax trade, with its RR and PA

Remember, the return to origin has the strongest chance of a bounce

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=25#11094

And EJ was just easy peasy

Sure, a touch of the cap would've been better, but a sensible entry later was still pretty stress free

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=25#11125

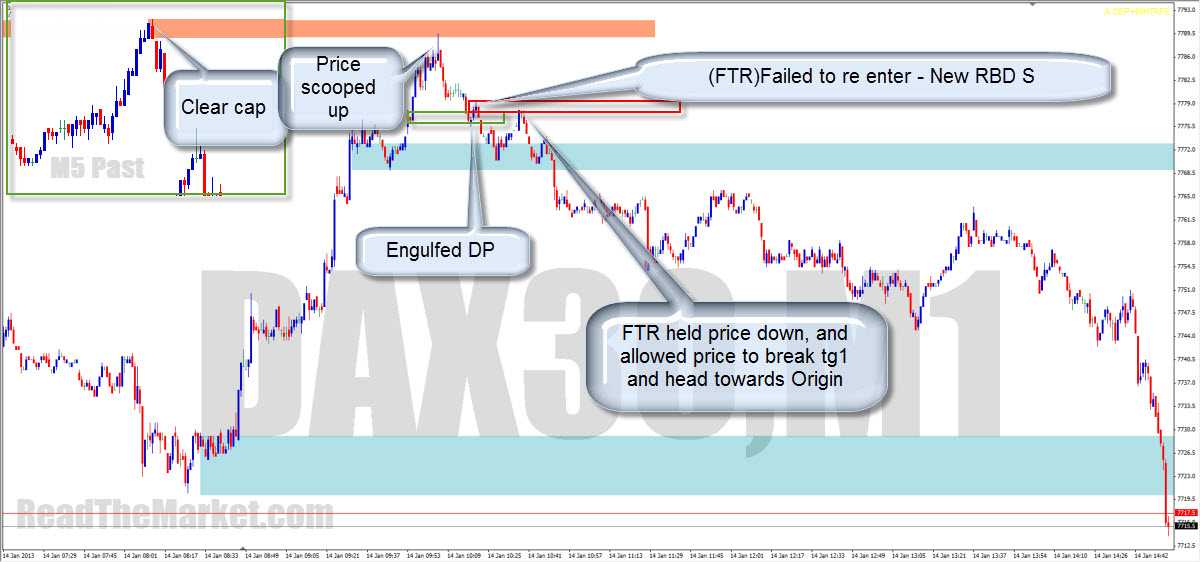

Follow up on Dax:

How simple was that?

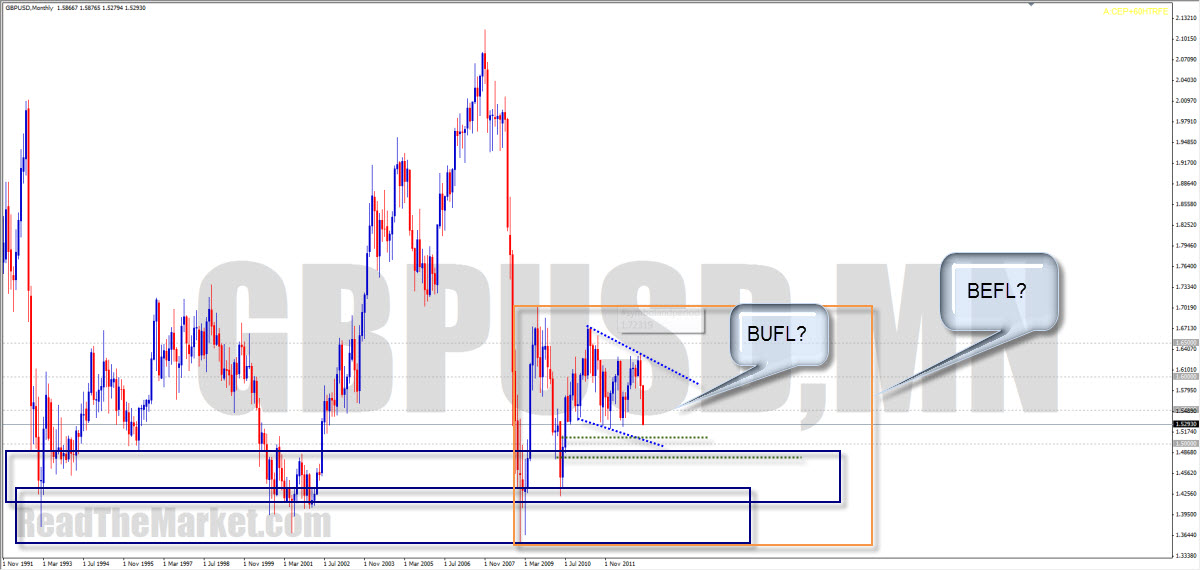

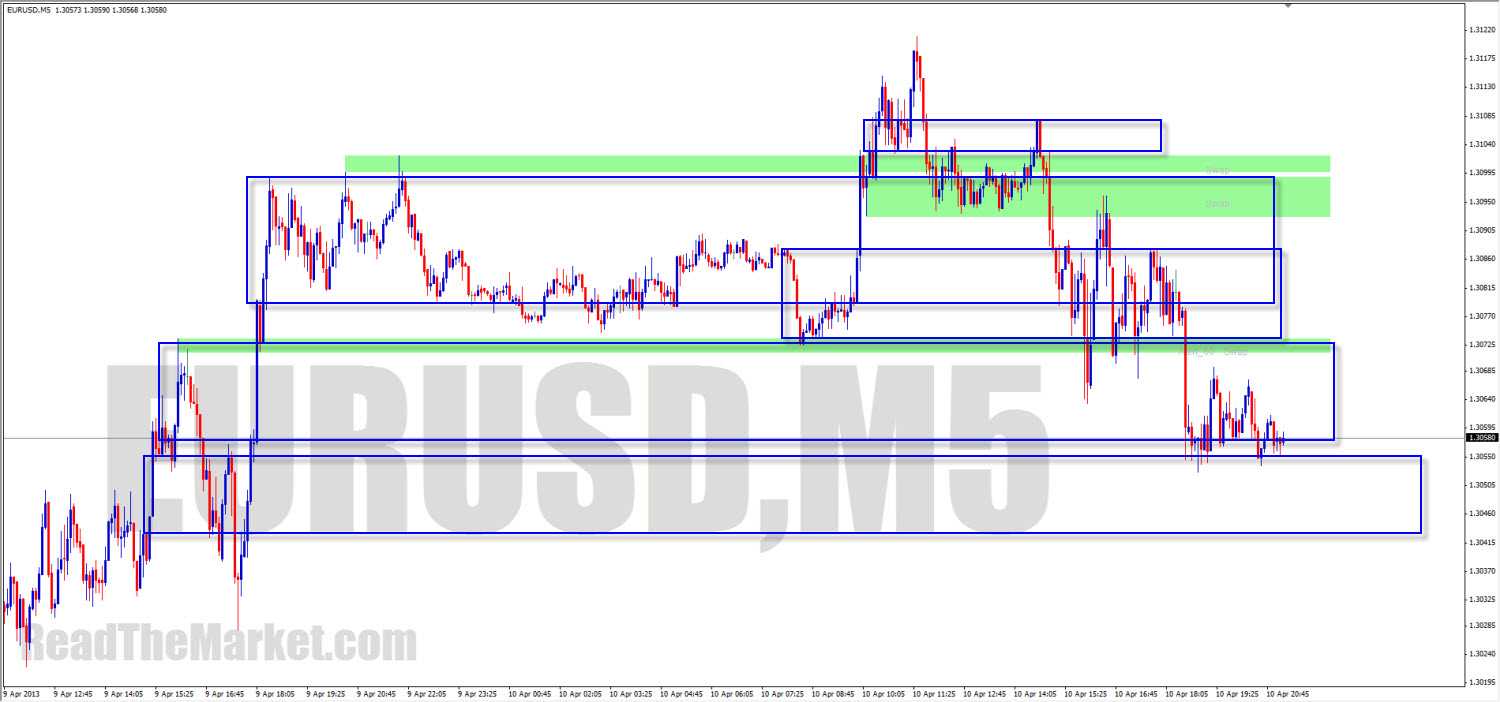

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=125#13392

I'd be very careful around this area

Demand created by demand etc is always to be considered stacked demand, and price can go all the way

Sure there are retrace trades to be taken on many timeframes, but beware that orders may accumulate for a wile around this level, which can be frustrating if you're looking for an easy swing

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=125#14230

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=125#14291

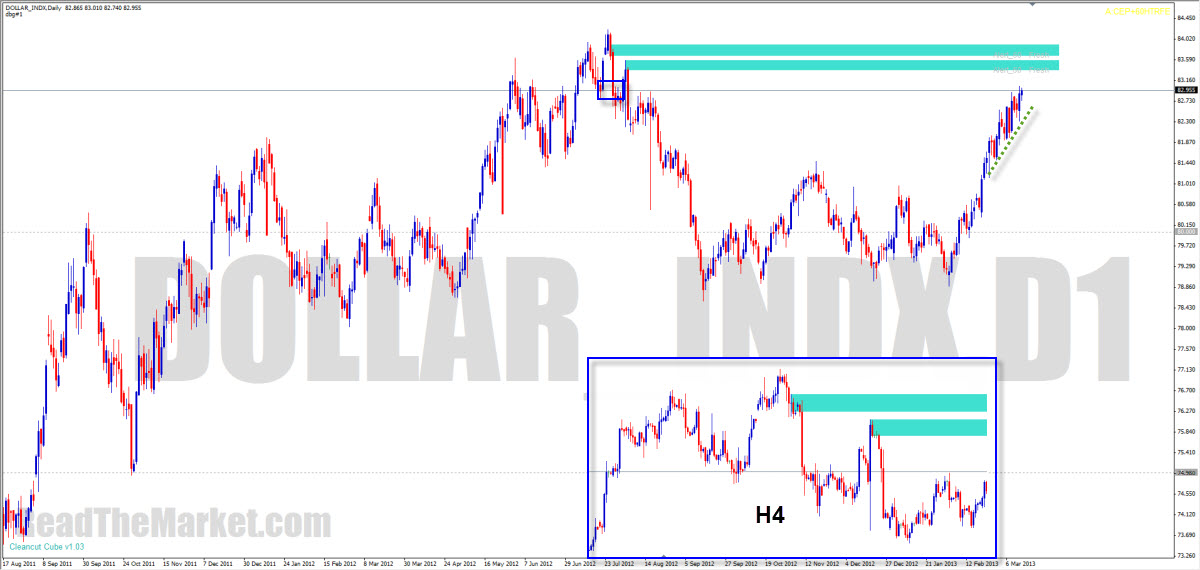

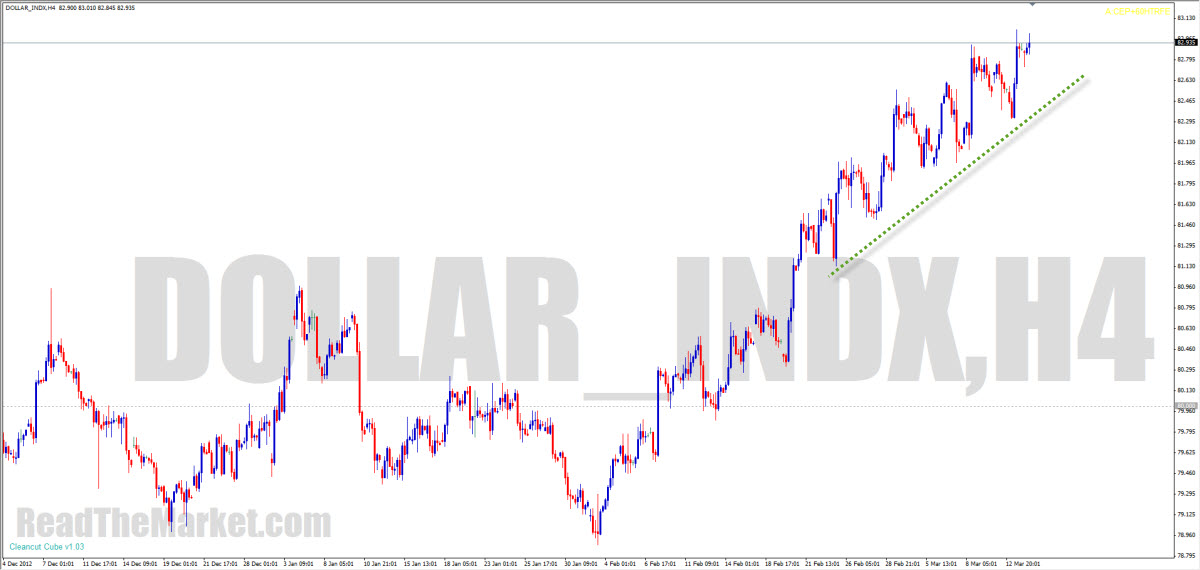

This is DX futures

What do these charts indicate?

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=150#14713

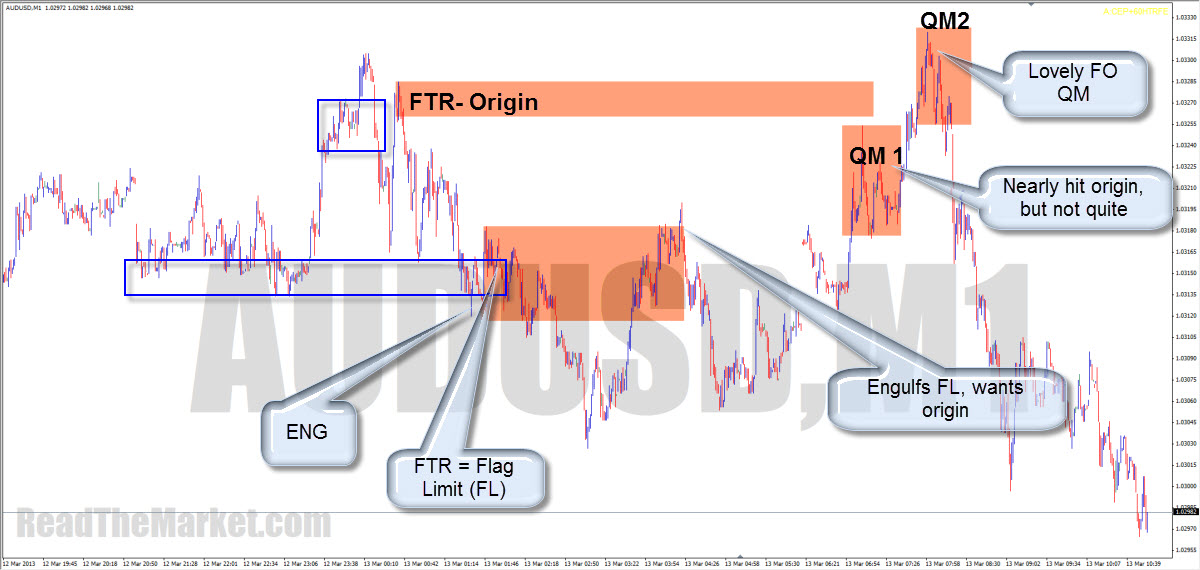

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=150#14854

Certainly there's an awful lot to learn here. But if I were to summarise what I think is most important, I'd say look to an engulf into free space that hasn't yet hit the origin (tg). Very often it will retrace deeply before advancing to the origin

Learn to spot these, and you'll be better equipped than most other traders out there.

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=150#14923

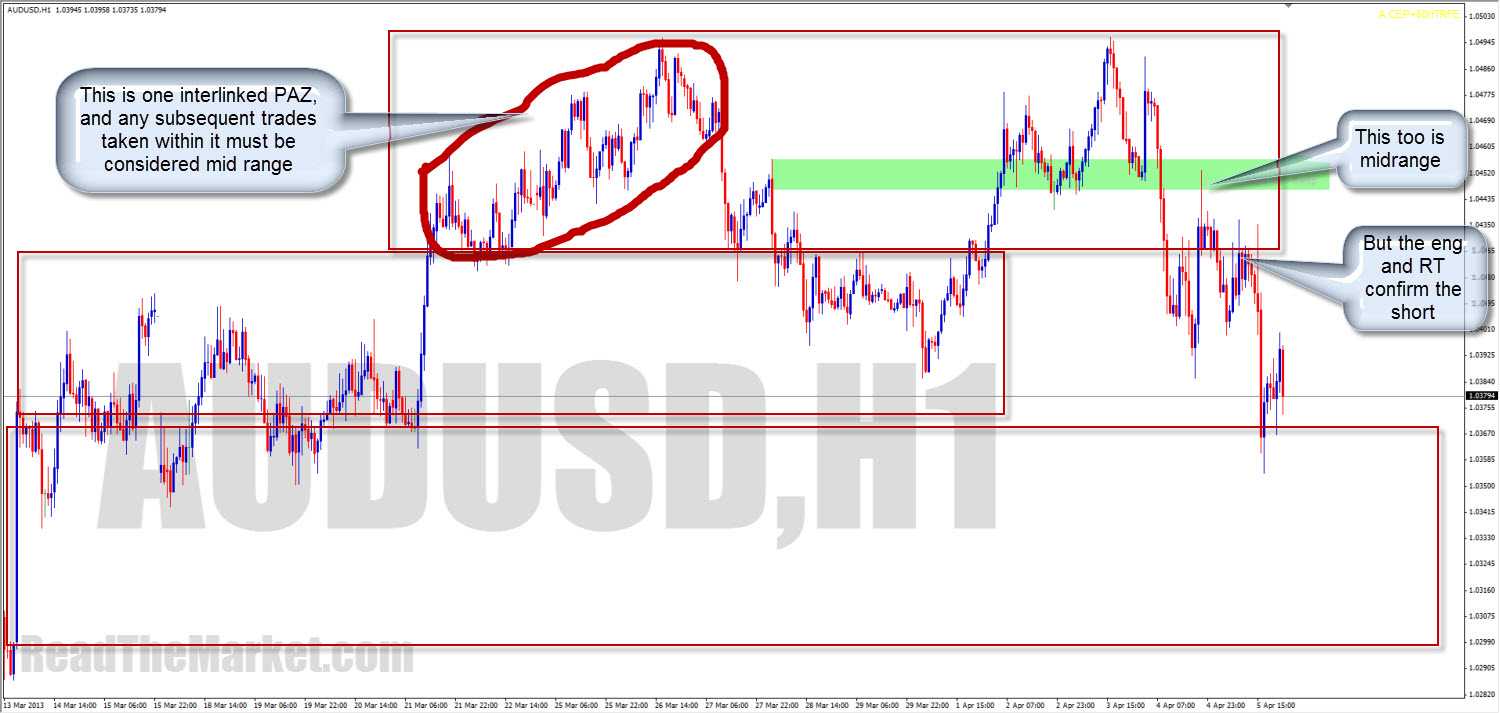

Price moves from PAZ to PAZ.

The clear target for any trade after an engulf is the other end of the PAZ in that TF

If you zoom out to HTFs, you may find the TG is even further, but if not, stick to the TF you're in

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=150#15137

In doing it, I want you to consider:

Flags/Poles

FTR (actualy the same as above)

Support/Resistance breaks (I hope you noticed by now that FTR is the precise science of this!)

PAZ (Same thing again!)

If you can tie all of these things together with the engulf, you have the unified theory of market dynamics, and you'll be astonished at how simple the market is to read. You'll actually be able to boil it down to; If X, then Y

I do hope you all have a go at doing this - It seems that the best lessons are the ones we work out for ourselves

All the info you need to get the answers is already here in the site - so go and put it together

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=200#15451

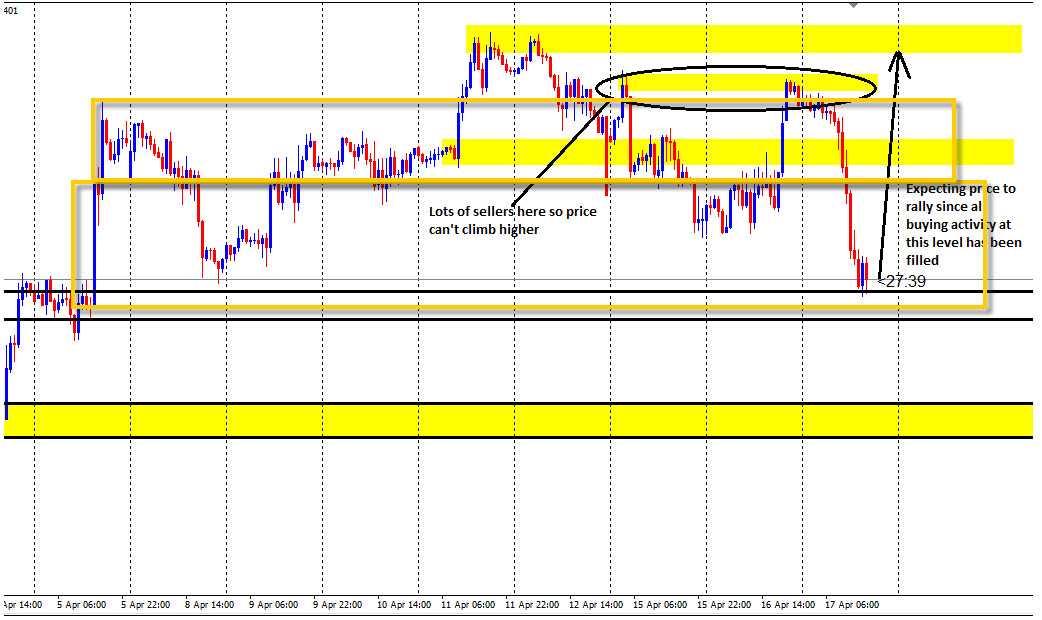

Here's a rule to live by in trading mid range, if you can't abide by the golden rule, which is "Don't do it!"

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=200#15473

Well, as you know, I see price either in flags or poles. Trading within the confines of a pole is, to me, midrange, as is trading within the confines of a flag

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=225#15488

Yes, in essence, it would be pretty accurate to say that price is either in consolidation or in a pole.

We're certainly safest trading from the extremes of either. Just look at when price breaks an high or low, with an FTR; see the rejection which so very often occurs from the new FL on return.

when this FL eventually breaks, price has entered the pole. Some may trade this break, but they must be ready to suffer DD right back through the flag, and sometimes even slightly beyond. Hence, for safety, it's usually best to let price break and form an FTR which we can trade from on return.

The tg is usually the base of the pole, but if price starts showing signs of compression through the pole, watch out for possible support/resistance flips along the way, especially if price hadn't hit its target before the flag broke back into the pole.

There are very many variables in this scenario, so to draw a set of charts for it would mean explaining every single PA setup there is. So I urge you to look through your charts and try to make sense of these words.

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=225#15492

Here's the one that got away. What a time to be on holiday!!!!!

I had for some time only one thin buy zone marked on the chart, but was I around when it hit? Hell no!

Why was this zone so important to me?

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=225#15758

Whatever TF you're trading, price will travel from the last zone defined to the next last zone defined

It's always best to be very aware of the HTFs too, as the PA forming in your LTF zone may also be at the edge of an HTF zone, potentially offering much greater rewards than your TG in this TF.

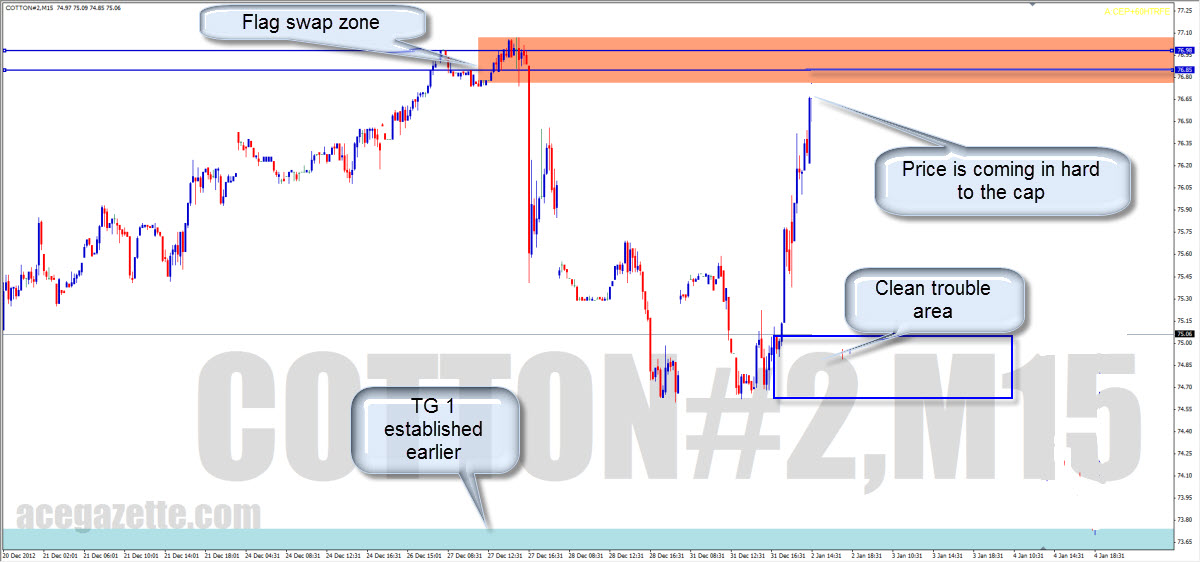

Here's an example of simple, no-brainer trading on recent zones

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=225#15766

Why did I sell, and how did I know what TG1 would be?

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=225#15768

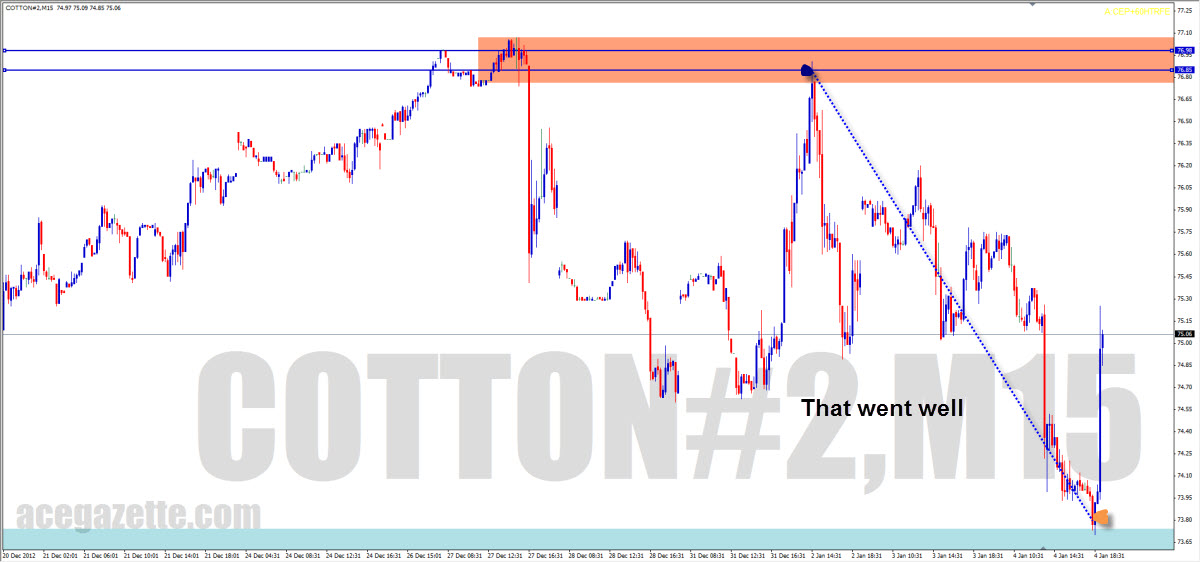

Well almost. It was the PA in the past that got me in, and yes, tg1 was the FTR after the break of the last high

These pips were definite :)

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=250#15784

I like your first reasoning very much

The drop signal came on an engulf of the original FTR

For now I'll be keeping that FL as the edge of my PAZ

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=250#15792

F

or me these levels get used again and again as the edges of PAZ's

or me these levels get used again and again as the edges of PAZ'sYes I know this information initially will have you scratching your head, wondering "Why is he throwing this extra dimension at me?!!!!!!!!"

But over time you get used to seeing this stuff, and you'll know your zones without even realising you saw them

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=275#16002

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=300#16077

I took the trade for the reasons the guys stated above. It was a lovely FTR on every TF, and a beautiful cap (see the m15 from the past). It had every possibility of retracing price deeply.

As it went though, there were decent returns to be made on it, but nothing massive

Here's how I managed it

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=350#16425

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/33-supply-and-demand-support-and-resistance-pa?start=550#9747

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/33-supply-and-demand-support-and-resistance-pa?start=625#10584

We love our QM levels, and we love our price caps (in this case, a well pronounced RBD) and our CP into a level, we love engulfs on reaction

Here's the trade call for it:

Corn on approach. See readthemarket.com/index.php/forum/classr...e-pa?start=650#10584

No great cp into the zone, but the RBD was a very strong cap on price, so expect origin at least

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/33-supply-and-demand-support-and-resistance-pa?start=1025#14415

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/33-supply-and-demand-support-and-resistance-pa?start=1025#14463

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/33-supply-and-demand-support-and-resistance-pa?start=1050#15138

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=275#16002

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=325#16291

There certainly are range opportunities here

Watch PA at the edges of the PAZs for clues

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/33-supply-and-demand-support-and-resistance-pa?start=1100#16449

Also, always be aware of what a Zone is reaction to, and look for historic prices that have nice RBDs and DBRs in the most recent history

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=450#17980

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=450#18030

When so much of what we've learned is aligned, we can trade without fear

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=450#18044

A FL is where a PAZ gets broken and price FTRs

This is a perfect example of it

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=450#18067

I let PA take me out

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=475#18107

LP: So, from what has been said so far today it arises that rejection from cap (aka FTR) is at the same time FLAG LIMIT...

And the edge of the PAZ

There's no other lesson to be taught

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=475#18120

DrSwing: And in my own words :) , "The level at which price leaves a zone and fails to get back into the zone is the FTR (FL). So we now have a PAZ above the FTR and another PAZ below the FTR, and we can operate within these individual zones".

EDIT: oh, and the FTR (FL) level is the DP between the PAZs.

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=500#18378

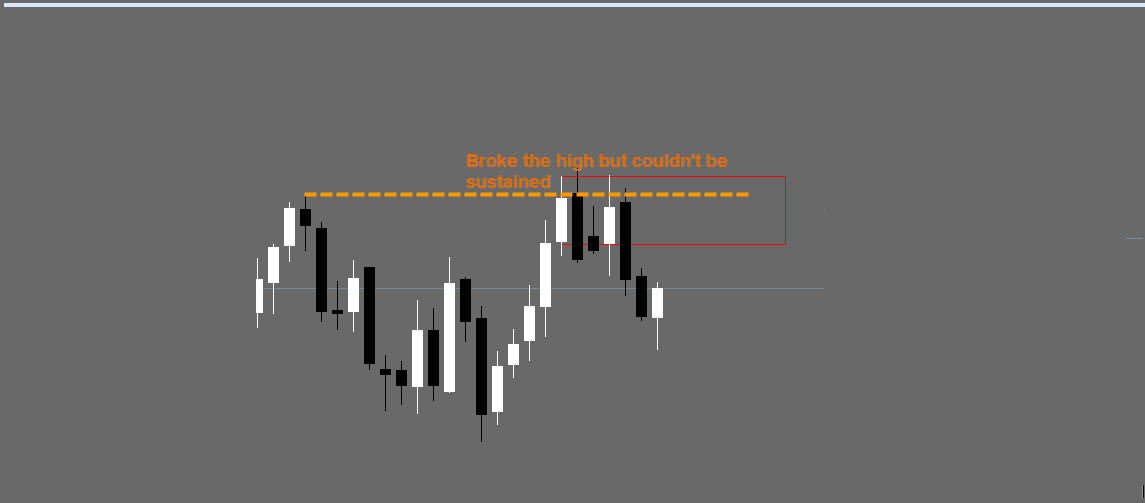

Simple explanation of Compression formation

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=500#18479

Allow me to give you one big clue.

In fact, for many of you, it may be the last thing you need to know for that massive EUREKA moment to occur

Once it does, you'll be advancing to the Associate Traders rung, where I'll fine tune it for you, until you're ready to go to the Master Traders Room, where I'll lay it all out on a plate

So here goes

A CP is a PAZ

If you're having trouble spotting your PAZ, look to a CP zone,, look to its engulf and FTR. That'll be a reference for all your further PAZs

Raven, you'll need to look further left for PAZ engulf and FTR in order to draw your PAZ1 properly

Each PAZ remember, is formed by the FTR after the break of the last PAZ. (that's why, when you look across a zoomed out chart, you can see Zones lining up in bands all across the chart, be they flags, poles or empty space. The don't line up to the pip though because it's the break of one and its FTR that creates the next, offsetting it one way or the other each time :) )

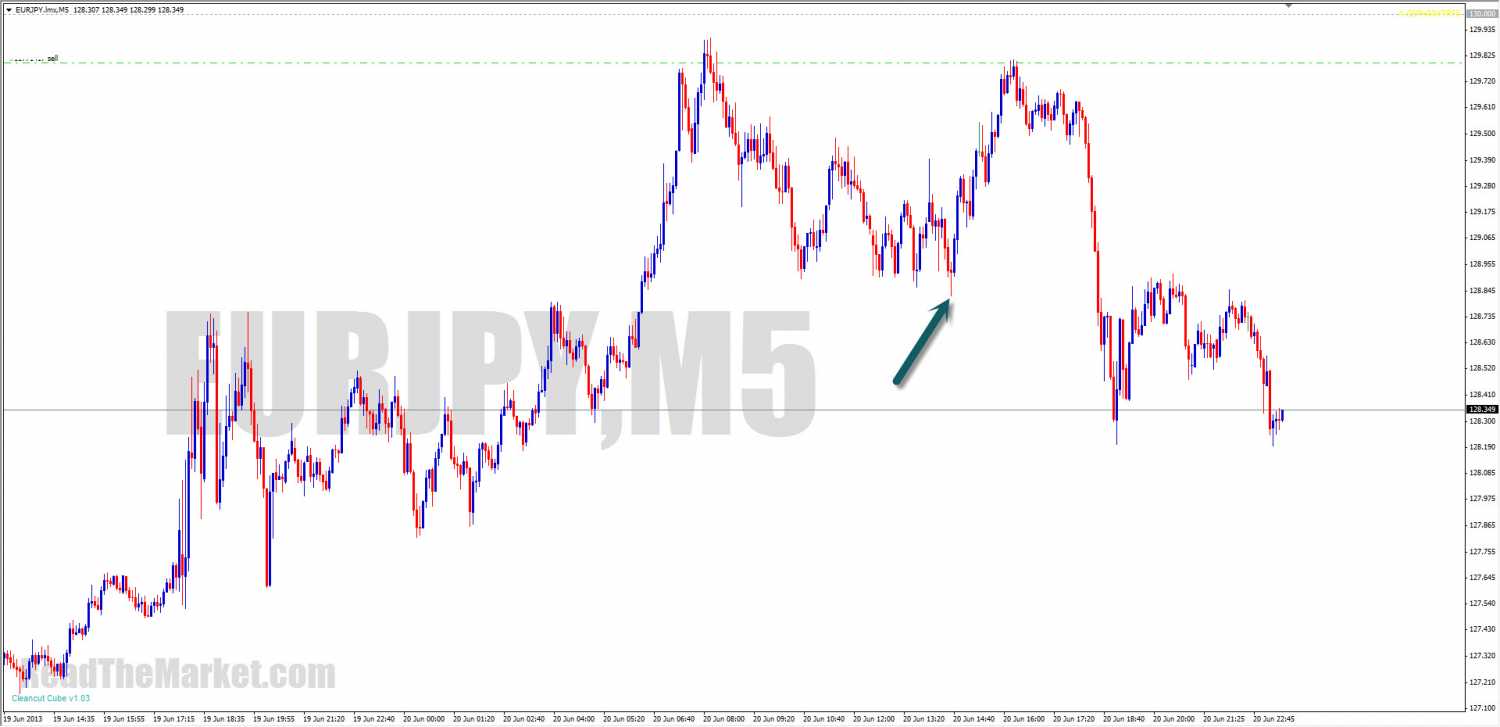

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=625#20349

The green arrow points to the moment I planned this trade

Why?

Also, how did I pick my entry?

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/1517-the-classroom?start=675#21122

https://readthemarket.com/index.php/en/forum/classroom-and-trading-room/2376-supply-turns-demand-why#48080

There's no need to look at in terms of order flow.

The ITs don't tend to turn price in random places. Far from it; they're extremely precise.

This is just one of those places they aim for. That, however, is no reason to trade every return to RS. If they haven't gotten everybody trading the wrong way into them, they've no reason to stop price there

Comments

Post a Comment