Over & Under

Quasimodo

The

Quasimodo is a beautiful and powerful Price Action structure.

It

gives a big sign that the big money is ready to change price direction. It

often serves to trick the uninitiated into giving up good positions to them,

allowing them to get big orders filled.

We

look for them at areas of Supply and Demand, where

we look for all our trades, and use them as confirmation that price has turned,

due to the engulf that

occurs in their formation

A QM doesn't need to form all at once either

Here's a video of one which took many months to form - it was also one of my favourite trades ever

Here's a video of one which took many months to form - it was also one of my favourite trades ever

http://youtu.be/JufS5cKBVng

Homework:

Find at least 60 QMs through history and file them. Mark the zones they're reacting to, and where price went to next.

Find at least 60 QMs through history and file them. Mark the zones they're reacting to, and where price went to next.

They can be in any TF, any pair. Find ones

that worked, and ones that failed. You'll learn from both

QUASIMODO

QM is a reversal pattern if used in

the right locations. The best place (as always) to really assess it's potential

is to look at your charts. You'll learn more by looking at your charts than you

will any book or forum - get the basics from here and then go and spend hours

pouring over your charts until spotting QM's etc and where / how to trade them

are part of your subconscious.

In terms of the 'why' they work,

let's take a short QM setup...

1. When it forms the 2nd high this

is where the professional money is shorting - this is also where novice sellers

/ weak hands have placed there stops and breakout / trend traders have placed

long orders.

2. Price making the 2nd low is in

affect the tip off that a reversal is coming - a seasoned trader spots this and

is looking to short. If this new low also happens to trigger a break of a

significant level / TL then all the better - the more noticeable the location

the more likely clever traders are looking to enter the market with shorts.

Of course the new low also trips

some stops and encourages novice shorts on board who look to bail out as price

retraces - breakout traders are weak players who don't hold for long - this

helps the 'distribution' process and allows the Pro's to load up shorts on the

retrace to form the RS - you should be able to predict where this RS 'should'

form.

3. The process is complete - Pro

traders are fully loaded on shorts, weak hands have been had their orders

utilised for liquidity and now the reversal can play out.

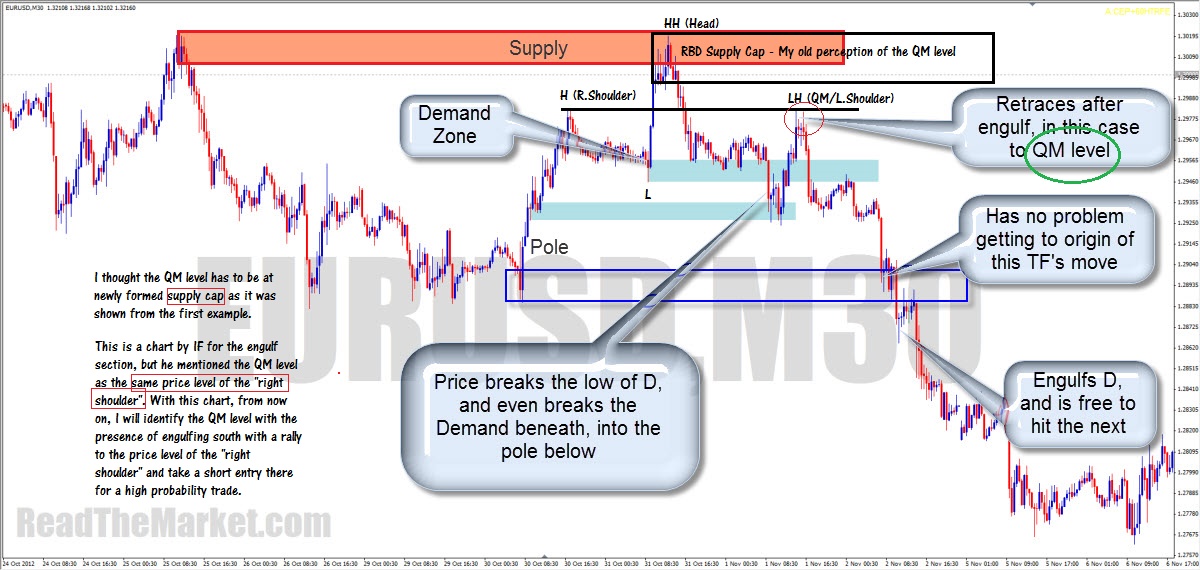

(IF) In a QM at S, sure we look for

the break above the initial H, which is where the buyers get trapped, but it's

the DP to break back down after the HH that we look for in a QM, which need not

be exactly at the level of the left shoulder.

(IF) If price initially turned

before Supply or Demand, price can often break it, attracted to the true zone

QM chart example.

(Benhur) You spot the Quasimodo

pattern well. But like any other pattern it is more important to acknowledge

the context of the pattern. The Quasimodo and any other reversal pattern we

want to see occurring as a reaction to extreme levels (SD / SR).

(Harry) QM is really a great PA

confirmation to enter trades at places you would consider an entry. helps a lot

with itchy fingers. if you say "i will mark areas of interest and wait for

price to get there and then watch for a QM for entry" your chances of a

wining trade increase a lot. keep an eye for what the engulf engulfs, to get

even better odds (say it engulfs a FL for example).

Scale: http://readthemarket.com/index.php/en/forum/homework-quasimodo/31-the-quasimodo?start=700#32363

(Harry) there are no timeframes, its

all fractal. only smaller and larger swings/flags/call them what you want.

switching between timeframes in your platform, only helps see them

say you have a swing engulf in

whatever you consider be a HTF.

now price returns to it so you

expect a reaction there, then look for a reversal engulf (QM style) in a LTF

although a QM may be visible in the

HTF too.

QM expert: Quidsey from FF: http://www.forexfactory.com/showthread.php?t=444458

QM expert: Batus from FF: http://www.forexfactory.com/showthread.php?p=9170223#post9170223

The Diamond

The diamond is one of the most deceptive price

structures there is in the market.

It catches both buyers and sellers alike, and can fill massive orders for the big guys.

At Supply, it involves an engulf South, fakeout North, and reversal South - vice versa at Demand

Since a picture tells a thousand words, here are some charts

It catches both buyers and sellers alike, and can fill massive orders for the big guys.

At Supply, it involves an engulf South, fakeout North, and reversal South - vice versa at Demand

Since a picture tells a thousand words, here are some charts

This is one reason why you should know exactly

where to place your stops, and have the faith in the zone to leave your stops

there

The CanCan

Very often price will move into, or even better,

break out of a zone with strong momentum, creating a pole.

Usually a pole will have a flag on top,

gathering orders for price to avance.

But if the flag breaks back into the pole, this

is a significant turn in value.

A CanCan can often occur at such an event.

Price moves hard, flags briefly, and moves back

quickly with a Liquidity Spike. This liquidity spike will mean there may very

well be orders left to be filled at the edge of the flag, so you'll very often

see compression back towards it, with extra orders being

hidden, so that when price hits the cap, it can shoot back through the

compression and on to the base of the pole.

Here's an example

and another

RTMA LITE COURSE

https://readthemarket.com/index.php/en/forum/homework-quasimodo/31-the-quasimodo?start=125#4395

We can get into trouble looking for a "to the pip" entry on a QM.

In a QM at S, sure we look for the break above the initial H, which is where the buyers get trapped, but it's the DP to break back down after the HH that we look for in a QM, which need not be exactly at the level of the left shoulder

https://readthemarket.com/index.php/en/forum/homework-quasimodo/31-the-quasimodo?start=125#4573

https://readthemarket.com/index.php/en/forum/homework-quasimodo/31-the-quasimodo?start=175#5979

IF"

https://readthemarket.com/index.php/en/forum/homework-quasimodo/31-the-quasimodo?start=175#6002

IF: The qm entry point is perfect, but reaction is important

What reaction PA do you see after the level?

Gil: let me know if I understand you correctly.

It was needed to abort the short position because it was CP-ing down to fresh demand?

So that trade would necessarily had to fail.

https://readthemarket.com/index.php/en/forum/homework-quasimodo/31-the-quasimodo?start=200#6331

https://readthemarket.com/index.php/en/forum/homework-quasimodo/31-the-quasimodo?start=275#9358

https://readthemarket.com/index.php/en/forum/homework-quasimodo/31-the-quasimodo?start=1175#54748

https://readthemarket.com/index.php/en/forum/homework-quasimodo/31-the-quasimodo?start=1175#54866

DM by LP

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=50#28478

by DrSwing

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=75#29753

in2forex:

Prelude

I know that at the SUPPLY area above (above the white line) a lot of traders will be prepared to invest some money. It’s a good liquidity area, I also know that I’m going to turn price at that level, but I’ve got a lot of sell orders to fill and I can’t fill them all at once. I need to entice traders to buy so I can sell against them.

a) So I start buying hard with a short burst just enough buy orders to get retail traders following me, they think this is the last push up to SUPPLY, I've got my first load of buy orders I can sell against and I start filling my orders, I've got a lot of them so price starts to fall.

b) I need more sell orders so I buy pushing price up just enough to entice retail traders to follow me. I mean the move at (a) was just a retracement wasn't it. I push price up and then sell against the excess buy orders making sure I clear all the orders at demand on the way up (compression). I've accumulated a good number of sell orders in this process, and the sell orders I have are in greater numbers than the buy orders I used to move price.

c) Ok it’s time to mess with these traders, I know lots will buy the break of the high at (a), So I start buying hard but immediately sell against the buying spree (price drops). Strong buy again , retail think this is going higher, I start filling my sell orders and I keep adding more and more.

d) Price drops like a brick. Ahh look the suckers think this is the reaction to the supply zone and are joining me selling and placing there stops above the new high. I could use those stops very effectively, and if I buy now I can still make a small profit on my buy orders when I close them at the fake out level. So I start to buy, slowly at first I must make it look like price is going higher. Buy hard to push price up and as retail try to follow me I sell against their buy orders making sure I’m clearing all the orders left at fresh demand (d).

e) Time to create havoc. I buy hard, It’s aggressive, some retail want In and start following me, others have sell orders which risk being stopped out price breaks the high, more buy orders from retail as they chase the break, other retail stops are hit, sell, sell, sell, against all these orders. In the process I've also closed my buy orders I took at (d) with a small profit , I don’t need them on my books.

f) There are going to be some buy orders left at the flag (g) I need to consume these and open the path down. I start buying using the orders left at the flag (g) to assist me, buy up in a burst, and sell against the retail traders that try following me. I know I have tiered out retail by now and I have enough orders filled, I just make sure to clear any final sell orders left at SUPPLY (e) using them to start the move down.

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=75#29773

in2forex:

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=75#29886

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=75#29888

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=75#30879

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=150#47596

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=175#52041

HI RTM

I intend to continue my trading journey here,thanks a lot for sharing your knowledge all masters and traders . hope i learn from you and can also help others .

before starting my attempts on DIAMOND thread i want to write my understanding from DIAMOND .

i wrote some notes about it in " THE ART OF WAR " thread after that i finished QM thread and before starting this wonderful thread .

there are some questions that why a QM fail and why a DIAMOND from ?

in my idea QMs DON'T FAIL , let me write more clear :

real and correct QMs dont fail . and those QMs that fail are WRONG one .and DIAMONS are the correct QMs .

the thread QM has a few important points . like :

wait for QMs forming in HTF ZONES .

DON'T trade QM's pattern ,it's not a pattern it's a kind of FORMATION .

but in my idea there is an important point here . we must wait for QMs forming in HTF zones if there is no IMPORTANT UNTESTED DP BELOW (for demand zone) and HIGHER (for supply zone ) .

so that the ITs reach the price to those IMPORTANT DPs and where retailers SL is located there. i want to say that in DAIMOND IT's SL NEVER HIT .

DIAMOND is a reversal formation . why i say formation ???

because it's not a pattern , i am here in RTM for 3 months and i learnt in this period that i shouldn't trade the patterns . as DR SWING SAID in this thread :

all the world know H&S and the ITs also see it

so that H&S IN WRONG PLACE is a really good opportunity to grab more orders from unsuspecting traders.

here in RTM we must try to learn how to read the market not how to see or watch the market .

there are a lot of difference between those listen to a song and those hear it .

so that i try to investigate some DIAMOND FORMATION in next posts in this tread .

HERE is one that i traded it now

but why that QM was WRONG ???

because in the history of the market there was an untested DP . that was really nice for grab some more orders from novice buyers and make a correct QM for others to join the rally .

AND the trade of correct QM :

why this QM failed ???

whay diamond happend and the out put was rally??

because it was a WRONG one.

in the end of this journey we will see the correct one

2.

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=200#54369

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=200#54371

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=200#55375

(Gil) I didnt read the thread you mentioned, but I did talk to a former IT trader. My impression of the IT trading, is that they care less for the patterns they create in the market. They have the ability to cause confusion in the market , and so they use it to take the amatures' money.

At one time i was talking to that IT trader, I asked him how he uses manipulation. He went to the whiteboard, and show me how he and hos team were causing confusions, with his pencil he draw me all sorts of quasimodos and diamonds. I asked him if he has any name for what he just draw. He said, he just go to work and do it. he as no awareness he is creating any pattern in the market, and he doesnt even care, as long as it makes him money on everyday basis.

In conclusion, I agree with you trading like IT is total different thing then following the IT. We as traders should expect their manipulations. once we see the confusion happening, we should know they come to action.

It was needed to abort the short position because it was CP-ing down to fresh demand?

So that trade would necessarily had to fail.

https://readthemarket.com/index.php/en/forum/homework-quasimodo/31-the-quasimodo?start=200#6331

https://readthemarket.com/index.php/en/forum/homework-quasimodo/31-the-quasimodo?start=275#9358

https://readthemarket.com/index.php/en/forum/homework-quasimodo/31-the-quasimodo?start=1175#54748

https://readthemarket.com/index.php/en/forum/homework-quasimodo/31-the-quasimodo?start=1175#54866

DM by LP

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=50#28478

by DrSwing

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=75#29753

in2forex:

Prelude

I know that at the SUPPLY area above (above the white line) a lot of traders will be prepared to invest some money. It’s a good liquidity area, I also know that I’m going to turn price at that level, but I’ve got a lot of sell orders to fill and I can’t fill them all at once. I need to entice traders to buy so I can sell against them.

a) So I start buying hard with a short burst just enough buy orders to get retail traders following me, they think this is the last push up to SUPPLY, I've got my first load of buy orders I can sell against and I start filling my orders, I've got a lot of them so price starts to fall.

b) I need more sell orders so I buy pushing price up just enough to entice retail traders to follow me. I mean the move at (a) was just a retracement wasn't it. I push price up and then sell against the excess buy orders making sure I clear all the orders at demand on the way up (compression). I've accumulated a good number of sell orders in this process, and the sell orders I have are in greater numbers than the buy orders I used to move price.

c) Ok it’s time to mess with these traders, I know lots will buy the break of the high at (a), So I start buying hard but immediately sell against the buying spree (price drops). Strong buy again , retail think this is going higher, I start filling my sell orders and I keep adding more and more.

d) Price drops like a brick. Ahh look the suckers think this is the reaction to the supply zone and are joining me selling and placing there stops above the new high. I could use those stops very effectively, and if I buy now I can still make a small profit on my buy orders when I close them at the fake out level. So I start to buy, slowly at first I must make it look like price is going higher. Buy hard to push price up and as retail try to follow me I sell against their buy orders making sure I’m clearing all the orders left at fresh demand (d).

e) Time to create havoc. I buy hard, It’s aggressive, some retail want In and start following me, others have sell orders which risk being stopped out price breaks the high, more buy orders from retail as they chase the break, other retail stops are hit, sell, sell, sell, against all these orders. In the process I've also closed my buy orders I took at (d) with a small profit , I don’t need them on my books.

f) There are going to be some buy orders left at the flag (g) I need to consume these and open the path down. I start buying using the orders left at the flag (g) to assist me, buy up in a burst, and sell against the retail traders that try following me. I know I have tiered out retail by now and I have enough orders filled, I just make sure to clear any final sell orders left at SUPPLY (e) using them to start the move down.

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=75#29773

in2forex:

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=75#29886

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=75#29888

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=75#30879

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=150#47596

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=175#52041

HI RTM

I intend to continue my trading journey here,thanks a lot for sharing your knowledge all masters and traders . hope i learn from you and can also help others .

before starting my attempts on DIAMOND thread i want to write my understanding from DIAMOND .

i wrote some notes about it in " THE ART OF WAR " thread after that i finished QM thread and before starting this wonderful thread .

there are some questions that why a QM fail and why a DIAMOND from ?

in my idea QMs DON'T FAIL , let me write more clear :

real and correct QMs dont fail . and those QMs that fail are WRONG one .and DIAMONS are the correct QMs .

the thread QM has a few important points . like :

wait for QMs forming in HTF ZONES .

DON'T trade QM's pattern ,it's not a pattern it's a kind of FORMATION .

but in my idea there is an important point here . we must wait for QMs forming in HTF zones if there is no IMPORTANT UNTESTED DP BELOW (for demand zone) and HIGHER (for supply zone ) .

so that the ITs reach the price to those IMPORTANT DPs and where retailers SL is located there. i want to say that in DAIMOND IT's SL NEVER HIT .

DIAMOND is a reversal formation . why i say formation ???

because it's not a pattern , i am here in RTM for 3 months and i learnt in this period that i shouldn't trade the patterns . as DR SWING SAID in this thread :

all the world know H&S and the ITs also see it

so that H&S IN WRONG PLACE is a really good opportunity to grab more orders from unsuspecting traders.

here in RTM we must try to learn how to read the market not how to see or watch the market .

there are a lot of difference between those listen to a song and those hear it .

so that i try to investigate some DIAMOND FORMATION in next posts in this tread .

HERE is one that i traded it now

but why that QM was WRONG ???

because in the history of the market there was an untested DP . that was really nice for grab some more orders from novice buyers and make a correct QM for others to join the rally .

AND the trade of correct QM :

why this QM failed ???

whay diamond happend and the out put was rally??

because it was a WRONG one.

in the end of this journey we will see the correct one

2.

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=200#54369

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=200#54371

https://readthemarket.com/index.php/en/forum/homework-diamond/1482-the-diamond?start=200#55375

IT = Institutional Traders

https://readthemarket.com/index.php/en/forum/journals/1523-if?start=875#36362(Gil) I didnt read the thread you mentioned, but I did talk to a former IT trader. My impression of the IT trading, is that they care less for the patterns they create in the market. They have the ability to cause confusion in the market , and so they use it to take the amatures' money.

At one time i was talking to that IT trader, I asked him how he uses manipulation. He went to the whiteboard, and show me how he and hos team were causing confusions, with his pencil he draw me all sorts of quasimodos and diamonds. I asked him if he has any name for what he just draw. He said, he just go to work and do it. he as no awareness he is creating any pattern in the market, and he doesnt even care, as long as it makes him money on everyday basis.

In conclusion, I agree with you trading like IT is total different thing then following the IT. We as traders should expect their manipulations. once we see the confusion happening, we should know they come to action.

(strudl)In trading we use two types of order. Market orders and limit orders. Market orders move the price, while limit orders provide liquidity. Lower is a table, which i will use for explanation of movement in the markets. Prices are taken from EUR/JPY. Size of orders is in lots. In real time there are a lot more limit orders and the difference between the prices and orders is smaller, but i simplified it, so it is easier to explain. In the orange part of the table we have offers(sell limit orders), in green part we have bids(buy limit orders). Two prices with gray background are best offer and best bid. You can see this information in upper left corner of MT4, if u have one click trading enabled. As we can see, in this example our spread is 2 pips.

As i mentioned market orders move the market. So for the price to move up to 140.10, a trader(or more of them) have to enter the market with market order at the size of 50 lot. If we want lower prices, we need sell market orders with the size of 80 lots, for a move to 139.90 and 90 lots, for a move to 139.75(in this case we would sell 80 lots at 139.90 and 10 lots at 139.90).

Example 1: If someone with big pockets would buy 300 lots of EJ, price would go up to 141.15(first 50 lots would get a fill at 140.02, next 20 at 140.10, next 80 lots at 140.25 and so on, all the way to the top) and only 5 lots would be left at that level.

So from this understading we get explanation why liquidity gaps happen. For example IT(institutional traders) are entering the market with HUGE sell market order. So price moves down, consuming all buy limit orders, until all positions of ITs are filled and price settles.

Us, the retail traders have one big advantage comparing to professional money. We get a fill at every price we desire to enter. So even if i enter with big position(our big position is nothing comparing to ITs), i will get a fill at the price i enterted, no matter what. That is not true for ITs, what makes their job a little trickier, which takes me to our next topic.

FAKEOUT

There is a topic about FO in the forum, if someone wants to see many examples on how FO looks. Bellow i have random illustration of price movement. In green square we have a FO. Many times we see it as a spike, but it can also look like illustration in purple square(just imagine that instead of green square, there would be purple), or any other shape.

So lets take a deeper look, what is happening and why on the provided image. Price is getting closer to supply in blue square and comes to supply at 1. ITs want to sell huge volume here, but they have 2 problems. First is the lack of liquidty, so if they would just enter the market with all the orders, they would cause liquidty gap, and not all the orders would get a fill at the price where supply is, but at a lot worse prices. Second problem is that many other retail traders also want to sell here with them, since we are in supply. So what is the solution for this problem?

They let other traders to sell(many of them put stop loss just above previous high). Then ITs drive the price up(no.2 on the chart). Here price hits SL from the traders i mentioned before, transforming their sell positions to market buy orders. Also the breakout traders start buying. But if there is so many buy orders, why it doesn't cause liquidty gap up? Because ITs are waiting with their sell limit orders, so they get a fill at good price. If FO would look like the one in the purple square, also trend following traders would start to buy, because of higer lows(no.4) and the traders who have a feeling, they will miss the move, also come on board. Here is also perfect place for ITs to unload buy orders from lower levels. After this, they push the price down(no. 3). Price hits SL of many long traders creating even more sell orders, adding more fuel to the fire, so price falls even harder.

https://readthemarket.com/index.php/en/forum/homework-rooms/1974-its#27956

https://readthemarket.com/index.php/en/forum/homework-rooms/1974-its#27959

(andyfx)First of all I want to point out the fact that in the forex market the "retail traders" are a very small part of the market volume (like 10% or less), while only the 10 major fx market partecipants hold around 80% of the total forex market volume.

I don't know it, but I can imagine that they aren't really interested in the orders of a bunch of dumb retail traders who are buying after a rally below a resistance (I don't think there is many people doing this). Retail orders isn't enough liquidity for ITs business.We can imagine that the majority of market partecipants know what they are doing and are no braindead. ITs are more interseted in steal other banks and big players money than the little retail traders, and this makes things more complicated, because ITs don't trade like us, but they mainly use HFT and complex algorithms to make trading decisions. We see a huge war of titans every day in the market. Of course it must be a logic behind price movements and where ITs compete to find liquidity for their positions and that's why pattern are created, like support-reistance, trendlines, indicator manipulation etc (to create liquidity clusters by creating beliefs in other market partecipants).

An other thing that I want to understand is how liquidity providers (large banks and financial institutions) can earn lots of money providing at any moment buy and sell limit orders above and below current price. They can earn from spread, but many times by providing liquidity they are on the wrong side of the market, like when they provide buy liquidity when price approach a resistance level where people starts selling. Liquidity providers dinamycs could maybe explain some price movements like when price retest the level after is broken, because liquidity providers, by providing limit orders around price, find themselves on the wrong side of the market and need to close without lose money.

https://readthemarket.com/index.php/en/forum/homework-rooms/1974-its#27965

(Vogon) First I agree with AndyFX when he says that the ITs don't pay much attention to retail. I think they are much too busy slicing each others throats. But think about the different motivations within the IT field.

The Governments at the top IT level probably have a lot of political and strategic motivations. Its a lot less messy to fight a currency war than a real one. They are probably responsible for moves like this.

Who do you think was selling at the top and buying (or at least adopting a more neutral position) at the bottom? Why don't I say outright buying? Because the market has not gone back up to the top but instead is in a narrowing triangle. Who knows what their net position is right now?

Now how about the large world banks and mega financial institutions. These are probably the most bloodthirsty, doing battle with each other on a daily basis while at the same time working together to take as much as they can from corporations and other businesses who need to make large FX transactions to run their operations. These banks and mega financial institutions are probably responsible for some of the normal HTF market swings along with the governments. But most of their actions are seen at the LTFs as they fight each other like some Alien vs Predator type battle.

But meanwhile, from low in the bushes, we monitor their every move, and we use our one BIG advantage. Super Agility. We can strike in an instant and be gone in an instant. They can not do this. Their actions take time and must be orchestrated. And this fight, this orchestrated battle being fought with many many sides, all attacking each other, creates patterns. These are the patterns that RTM teaches.

https://readthemarket.com/index.php/en/forum/homework-rooms/1974-its?start=25#28016

(DrSwing)

(Vogon) The yellow area is quite large. I've accumulated a very large position. I've unloaded some by pushing through the supply but I need a lot more to reverse my net long to net short. In fact what I really want is for other less sophisticated ITs to get bullish. lets go back toward the yellow to grab a bit more cheap longs than perhaps a push above the highs on this chart would do the trick.

https://readthemarket.com/index.php/en/forum/homework-rooms/1974-its?start=25#28031

(HotRod)We are told the reason the markets exist is to give value to an instrument. All the market participants with interest in an instrument come together to give the correct value to that instrument. This may have been true in the 1600s, but now this is a bunch of BS and assumes everyone obeys the law and follows exchange rules.

If everyone had the same access to the same information, then the market would truly be random because price could then only reflect all the differing opinions about that information. But what about information that would have an obvious effect on price? If everyone had the same opinion then the market would be "broken" because no one would want to take the other side of the trade. But where is the profit in that? If the true reason the markets exist is to find value, then they would make information freely available. They don't do that because the markets wouldn't work. The markets only exist so the people at the top of the money chain stay on top. Information is the most valuable commodity in this world and is kept in the closest of circles until it can be used for profit. The people who have it are the ones at the top of the worlds industries, and the banks that hold and loan them their money. You also have to include top governmental positions (financial) since the people who hold them are usually "experts" that were CEOs and such. These people have relationships with each other and we would be extremely naive (American public) to believe they don't use that for their own gain.

One of biggest things I took away from the book Trading and Exchanges is the concept of informative prices. Prices become informative when informed traders trade. Now this doesn't really help us take a position because there is no way of knowing when these traders are trading. But the concept does allow us to form a better view of the markets participants.

There are 3 types of traders: informed traders, uninformed traders, and uninformed traders who believe they are informed.

Informed traders: These traders have information that will effect the real world supply and demand, and are able to take positions in the instrument's market before the information has its effect. In the forex market it would be things like interest rates and policies, or major changes in a country's leading industry. This can also be the banks holding the order book, friends and family who were given tips, or people who are able to use a chart to see where these informed traders are taking positions.

Uninformed traders: People who just trade as a hobby, gamblers, News traders, people who only watch the right edge of the chart and trade off emotions.

Uninformed who believe they are informed: Pretty much anyone who gets their "education" from a book. You know, indicator traders, system traders. I would throw people who subscribe to these news agencies here as well since they usually end up getting fleeced. Some of these people probably make money, but most don't.

The idea here is that if the market was only made up of informed traders, then they would never be able to take a position. If all the informed traders know the same bullish information, then none of them are going to sell. This is where uninformed traders come in. So, how do they entice enough people to take the other side of their trades? First they put the perception out there that there is all kinds of money to be made in the stock market. (Economics class anyone? Ok that may be too far, but i doubt it. I'd say they have connections to the gov. positions that develop the curriculum) Then they herd us like a bunch of cattle. They know humans feel safer when in groups, and if they can get enough people following a certain way of thought, then others will follow.

So what do they use to herd us into groups so they can profit from us? Scheduled news releases with the CNBCs of the world to make people feel informed is probably the biggest. I'm going to guess the second biggest way is with all the "education" out there. I believe the material constantly being put out there comes from these same informed traders, either through straight up funding for it or some other way. But even if not, its out there, and can be used to fill their orders. How long has S/R been out there? Since Wyckoff in the 30s? Earlier? What about trend? Trend lines? All the different patterns that are taught and where to enter on them? And lots more. The stronger the following each "herding tactic" has the more profitable it is for the informed traders. The market mechanics of S/R is there yes, but it isn't going to have that strong of effect on the market, when it works its because the informed ITs are behind it. Yes it all works sometimes, until it doesn't. It serves two purposes, first to fill their orders and then to save them money when moving price to their take profit positions. What do all the educators preach? You have to trade it EVERYTIME and use good money management. All of this is herding. And don't forget that evil little ticker on the hard right edge for all the emotions. That gets manipulated as well, and always right into informed traders orders.

Informed traders are always going to stick together. They are out to make as much money as they can. And they aren't going to make much money by battling each other. They want the easiest prey possible, and the prey will always be uninformed. Whether they use their "herding tactics", or whether they want to "eat" their own and feed them some bad information, either way they are uninformed. There is always a battle, but the informed will always know they are going to win.

Vogon,

on your chart the sellers were informed, and the buyers weren't. Simple

I know, but its best that way. Any thing else and your head will become

clouded with unneeded thoughts which will lead to frustration. We can

paint any picture really, because there is honestly no way of knowing.

And being on the weekly chart it coulda been a central bank with bad

information, or maybe some uninformed ITs. This was back in 07/08 when

all the economic trouble began. Look where it peaked. It peaked in Nov

of 07, so whoever it was had their info at that time and started

selling. Any bullish info put out between that peak and the drop was all

manipulation to fill their orders and trap the buyers.

If you have ever read reminiscences of a stock operator, then you know Jesse Livermore made a killing off of the drop that caused the great depression. He traded by being able to read the ticker tape and knowing when the market was being manipulated, then jumping in with the manipulators. We would be very naive to think that it no longer gets manipulated.

So how can we profit from all this? I'm still working on that

In times of news droughts and on the LTFs the only real informed traders I can think of are the market makers. The people who can see the limit order book and know where the big orders are is the LTF uninformed traders enemy. But even he has weaknesses because he can only see limit orders, he doesnt know what market orders are going to come in and endanger his position. There could be a large IT out there who hits the market with a big market order to test a price level to see how dense the orders are there.(i believe this is one explanation for the engulf.) There are multiple market makers in the forex market in each instrument. They compete to provide liquidity to the uninformed traders. They don't have to provide liquidity if they don't feel they will make money on it. (only the NYSE specialists have to provide when they don't want to, and they can just widen the spread to protect themselves.) So if the market makers believe they have an informed trader entering the market they will just sit on the sidelines. If they were wrong the worse that happens is a competitor makes money and they don't. If they believe there are uninformed traders entering the market they will happily provide liquidity because they know chances are they will be in profit very shortly. I don't know the tactics the market makers use to discern the difference, but that is our job as well. I would say they can tell by how the orders come in or maybe make deals to get info.

Just by thinking about the tactics that uninformed traders use, and knowing how the informed traders use those tactics against them should give us a way to piece together the story of price. If we know where uninformed traders are going to put their orders, and we know that informed traders need those orders to trade, then we know where the battle is going to take place. If price doesn't do what the uninformed trader expected and he lost then there is a good chance an informed trader was active there, and then we just use the tools that IF and the gang have taught us and that will tell us to take action or stay on the sidelines. If price does do what the uninformed trader expected, then the informed trader sees an opportunity for more profit.

When I get time I want make a chart showing how I see it, but its late and im tired. GL trading today everyone!!!

https://readthemarket.com/index.php/en/forum/homework-rooms/1974-its?start=25#29399

(AERO)I definitely agree that for ITs using algo's, programmed by their intentions and rules definitely relieves them of time and imprecision.

Though i would just like to point out, basing on my recent research, using algo's doesn't necessarily mean HFT (High Frequency Trading) as it is very commonly believed now a-days. A light speed trading they call it, and the ones that have planted their asses the closest to the trading terminal, have the fastest execution.

Why would you fight for nano seconds?

As i see, most of these highly technically educated people are very brilliant at working out the best codes for taking the profit out of the market.

Though from what i have read and understood, their mindsets ONLY understand the markets microstructure and mostly just opt to gain return with tactical tricks.

Common practice is them offering liquidity to other manual traders, entering with a market order. Once the HFT's pending order is filled, they close it in a split of a second, just to profit on the spread the retailer has paid to get into the trade.

Ofcourse there are psychological tricks that go around these liquidity offering twists, but nothing is intended for a longer period of investing.

That is where the tight spreads come from! HFTs competing between each other and getting fees just for supplying liquidity to dealers.

Simply put, there is no long term strategy HFTs live by. A tactic is hardly successful if it isn't sufficiently applied within some bigger/higher-picture plan.

Plan being the engulfing signals and other.

Now, if u get a trader that understands the basics of HFT codes and the strategy, you get a golden boy, who can program and hugely lessen all the needed work and especially the risk.

~~~

Imagine: We hava a buying range. creting compression and a consistent buying in small lots is requiered,before we give a signal to break out and advance to next level. Doing it manually, well... :P Its exhausting, to say the least.

I know i would program the algo, tu buy small lots with market orders on the way up of the range, and just let the algo put pending longs, while price is retracing within a move. (If there is a scenario to break long.)

Big orders don't get a fill, and even more, you dont want to bust open the range, and bring confusion to other ITs faces, while they are happily loading their cargo.

(I believe there are even upper lot limits for market orders, with some brokers.

~~~

This is very interisting article that sheds light on alot of what HFTs are considered to be!

www.forbes.com/sites/richardfinger/2013/...aders-and-investors/

These topic has been hot since 2010 the FLASH crash. Contemplating wether these algos are of risk to the stability of market!

From what i read, people kept unplugging their sweet HFTs algos as they in horror observed DOW plunging.

That way they created volatility, price droped presumeablly to a targeted level and resumed back up!

(I havent checked since i got no DOW with my broker.)

Those in-the-moment-profit guys, considered it risky since they had no clue what was going on, and with such speed of price droping, their light speed pending longs would not get the return either. They dont even want to think about the loss scenario, due to over laveraging....

From my understanding, price has simply pushed to target and retraced. Driven by the IT traders (or algos), that were fully aware of the target for retrace.

Long term strategy won again. :D

If u have ever played chess - you probably know why. :)

https://readthemarket.com/index.php/en/forum/homework-rooms/1974-its?start=25#29662

(AERO)

pucci wrote: Morning Everyone,

1- Is it possible that a five year old area would still hold left over orders?

2- If I were an IT, would I have left pending orders there for so long? Especially that the framework in the mix of fundamental, geopolitical, economical, financial… etc... climate was surely different?

3- If the answer to the above questions is yes, wouldn’t brokers, market makers, liquidity providers and what have you, make a killing by just charging for those pending orders? (Just imagine the accumulated returns on a certain five year old level)

4- Wouldn’t we know about such interest payment requirements?

Hey Pucci.

You point out a very important idea, one i have troubled myself over aswell!

While, if one understand little market microstructure, one knows that pending orders can be placed and removed anytime, if not triggered.

As you mention, keeping them in place for years would end up in fees bigger than the profit could probably make. Especially for 50 years old ones.

Companies, brokers could have been abandoned by now also.

While it doesn't make sense, price still reacts beautifuly at the areas of interest. Even to the pip! But really, willing supply could be just spread around ... How can one know?

The idea i came up with and give for consideration:

While ITs intentions and needs are the tactics and strategy behind the candles!

While engulfing and defining levels are to be defined with "candles"!

So, by thoroughly studying ITs intentions, you could get the feeling for the drive of the market.

And by studying the FLs, compression, engulfs,... you get the picture where price will tend to go next!

In my opinion ITs look for levels rather visually! and arrange them so that when they are approached and hit, they bring about all the orderflow they need for their

fills! (that is what i thin IF means with - All the duckies are aligned

As you know, ITs can do anything they wish, so if breaking a level isn't such a big deal, then FO and ENG are pretty the same, orderflow wise.

They only need to set the rules how to visually and by strategic planing discern which is which!

They won't have orders standing at the 1950 level, if price ain't even near that!

But when the ENG shows price will go there for sure, they will visually see, that this level is within the flag we just broke into and so its viable to trade.

In the mean time, they prepare the battlefield for all the duckies and put the pendings there.

https://readthemarket.com/index.php/en/forum/homework-rooms/1974-its?start=25#30626

(Hotrod)

I finally feel like I understand enough to make a chart to go along with my post. Its funny how you can be right about something and still not understand why or how it works. But in reality we should be the ones that know the best how we get manipulated. Its extremely hard to break the shackles of "education", but once we do, we are educated. You know exactly where the losers are, because you were one.

This is just one example of how the ITs used and abused the retailers. It isn't how its gonna turn out every time. It will never look this way again, but because we have been through the ringer, and with the tools IF has given us, we can give a pretty good interpretation of whats happening. The more I study a chart the more I can see that IF has really given us everything we need. But just because its simple to him doesn't mean its going to be simple to us, and I also see just how much work has to be put in before it ever will be simple to me. Price doesn't have rules. With the ability of the ITs to put in massive orders, small orders, or remove orders that were just there price can take on any look. This is a game of cat and mouse. The only rule is make money.

This is an example of what I have been doing with the charts. I have just been going through the history and trying to explain what happened. Right now forex tester isn't going to help me until I can explain whats happening on the right edge like I can for history. This particular action on the chart sparked a question that I personally sought an answer to which led to a mental breakthrough. I put it in my journal in a vague way to see if anyone had any comments. But I haven't really proven myself with any good trades yet, so understandably no one said anything. I hope to soon, but honestly I am still in kind of an unbelief state that I may actually understand whats going on after all these years. Hopefully after much studying, FTing, and demoing I'll be posting good trades.

Comments

Post a Comment